|

|

|

|

| April 19, 2024 |

|

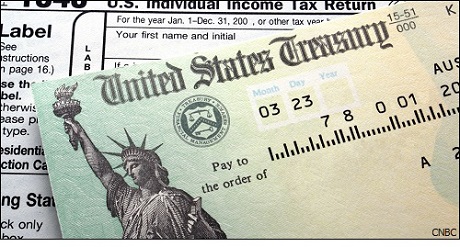

Are you owed an income tax refund from 2017?

There are an estimated 132,800 Californians who have not claimed federal income tax refunds because they did not file a tax return in 2017.

The IRS figures the average refund is $833 and those could total $130 million. Some taxpayers avoided filing because of unpaid child support or past due federal debts, such as student loans. Others didnít collect a refund because they didnít file tax returns for 2018 or 2019. There is a 3-year window to claim a tax refund. The deadline for the 2017 refund closes May 17th, 2021. For those who donít, the money becomes the property of the U.S. Treasury. Story Date: April 27, 2021

|