|

|

|

|

| April 24, 2024 |

|

Updating the case of renting vs a mortgage

INLAND EMPIRE – (INT) – Escalating home values may have finally turned the corner, but there’s growing discouragement from fast-rising mortgage costs.

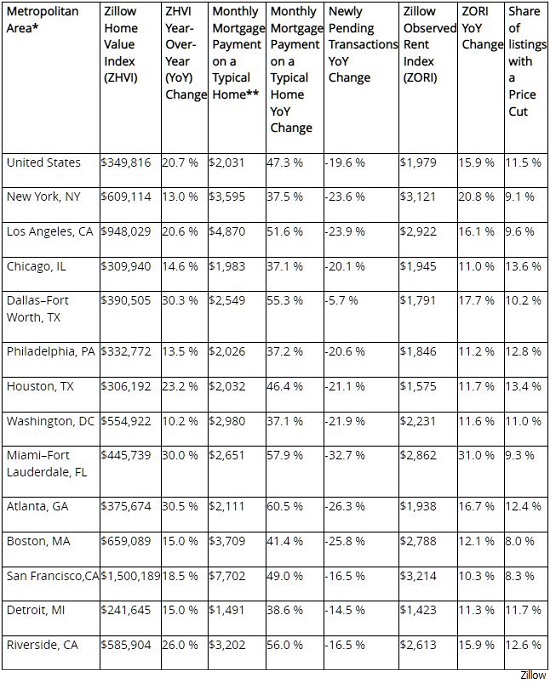

Rents have soared since early last year but compared to the rising cost of a mortgage, renting may still be the cheaper option. Zillow found monthly mortgage payments taking about 28% of homeowners’ monthly income — dangerously close to the 30% threshold, beyond which is considered a cost burden. Mortgages are less affordable than at any time since at least 2007. Demand for homes has pulled back in response, easing price growth, slowing sales and boosting inventory, according to the latest market report from Zillow®. In the Riverside-San Bernardino-Ontario metro: • The typical home value is $585,904, up 26% year over year and nearly 55% since 2019 • Mortgage payments on a typical home are $3,364 a month. • Typical rents are $2,613, up 15.9% since May 2021 • The share of listings with a price cut is 12.6%, compared to 9% in April Story Date: June 30, 2022

|