|

|

|

|

| April 25, 2024 |

|

Yellen tells nation’s bankers that the crisis is ‘stabilizing’

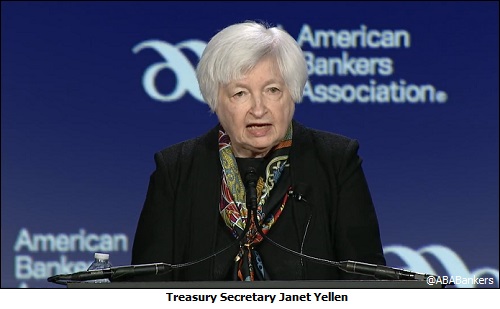

WASHINGTON - Treasury Secretary Janet Yellen tried to reassure the nation’s bankers on Tuesday that their industry is safe and sound, with the support of the federal government, as a banking crisis threatens the economy.

Speaking to the American Bankers Association, Yellen said steps taken to date – including an extraordinary rescue plan announced a week ago Sunday to assure depositors in two failed institutions they would have access to their money and other financial assistance made available by the Federal Reserve – should ease liquidity and credit concerns facing the industry. “The steps we took were not focused on aiding specific banks or classes of banks. Our intervention was necessary to protect the broader U.S. banking system,” Yellen said. “And similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.” The speech comes in the wake of failures at Silicon Valley Bank and First Signature Bank of New York, along with the firesale rescue of Swiss Bank Credit Suisse by that country’s government resulting in the purchase of the venerable institution by rival UBS. Meanwhile, the Fed began a two-day meeting to consider monetary policy, but that has already been overshadowed by questions about the stability of the global financial system. As recently as 10 days ago, analysts had penciled in a half-point rise in interest rates for the meeting. But that has since been ratcheted down with expectations now for either a 25 basis point increase, or none at all, when the decision is announced Wednesday afternoon. Banks, especially smaller, regional ones, are facing an exodus of deposits as customers seek the safety of larger banks while there has also been movement of money from banks that pay lower interest on their deposits into higher-paying money market accounts. This has the dual effect of destabilizing the smaller banks and tightening credit conditions throughout the sector. Many have weighed in on the need for the Fed to prioritize financial system stability over the fight against inflation. Hedge fund manager Bill Ackman argued for a pause on Twitter that “We have had a number of major shocks to the system. Three U.S. bank closures in a week wiping out equity and bond holders. The demise of Credit Suisse and the zeroing of its junior bondholders.” Meanwhile, there was some evidence that the crisis was easing, with embattled bank First Republic of San Francisco leading an early rally in regional bank shares. JPMorgan indicated it was helping First Republic shore up its capital base. The banks have been met with excessive withdrawals as a handful were caught without enough capital to meet depositors' requests. The rapid rise in interest rates by a Fed bent on cooling off the economy caused the long-term securities banks hold as reserves to lose their relative value, prompting institutions to sell bonds at a loss to meet withdrawals. The drop in activity in the tech industry also contributed to the demise of SVB. But, Yellen told the bankers that things were getting better. “The situation is stabilizing,” Yellen said. “And the U.S. banking system remains sound,” she added. “The Fed facility and discount window lending are working as intended to provide liquidity to the banking system. Aggregate deposit outflows from regional banks have stabilized.” (Source: US News) Story Date: March 22, 2023

|